The Accounting Cycle: 8 Steps You Need To Know

This new trial balance is called an adjusted trial balance, and one of its purposes is to prove that all of your ledger’s credits and debits balance after all adjustments. The accounts are closed to a summary account (usually, Income Summary) and then closed further to the capital account. Again, take note that closing entries are made only for temporary accounts. Real or permanent accounts, i.e. balance sheet accounts, are not closed.

Ready to save time and money?

Accounting software helps automate several steps in the accounting cycle. Depending on the solution, bookkeepers, certified public accountants and business owners don’t have to intervene or perform some accounting cycle tasks manually. Instead, they can set up workflows in their program of choice to complete various parts of the process. Another perk of using accounting software is the reporting functionality that allows you to generate essential reports and analyze your company’s financial health easily. Creating an unadjusted trial balance is vital for a business as it helps ensure that total debits equal total credits in your financial records.

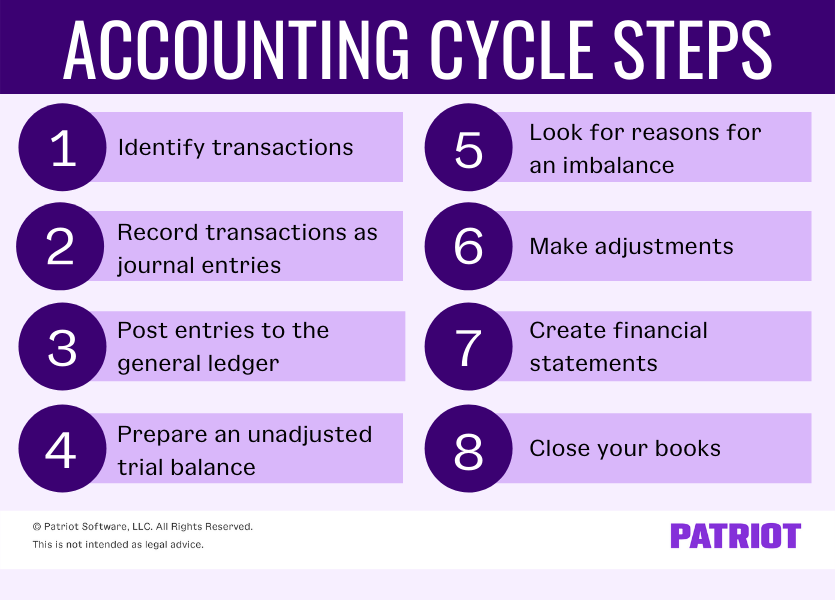

Steps in the Accounting Cycle

Through preparation, approval, execution, and evaluation, you’ll learn if you need to make cuts or expand. You close these accounts at the end of each accounting period because you’re ready to begin tracking a new month, quarter, or year of business. The ending balance of these accounts becomes the beginning balance for the next accounting period. This makes sense because you don’t lose all of your cash or automatically get rid of debt just because it’s the end of your accounting period.

What is transactional accounting?

One of the most commonly referenced accounts in the general ledger is the cash account which details how much cash is available. Regardless, most bookkeepers will have an awareness of the company’s financial position from day to day. Overall, determining the amount of time for each accounting cycle is important because it sets specific dates for opening and closing. Once an accounting cycle closes, a new cycle begins, starting the eight-step accounting process all over again. The eight-step accounting cycle is important to know for all types of bookkeepers.

Step 8: Close the Books

The main purpose of the accounting cycle is to ensure the accuracy and conformity of financial statements. Although most accounting is done electronically, it is still important to ensure that everything is correct since errors can compound over time. After closing, the accounting cycle starts over again from the beginning with a new reporting period. Closing is usually a good time to file paperwork, plan for the next reporting period, and review a calendar of future events and tasks. The accounting cycle is used comprehensively through one full reporting period. Thus, staying organized throughout the process’s time frame can be a key element that helps to maintain overall efficiency.

- Journal entries contain specific information relevant to the transaction, such as the date, transaction number, amount, description, and which accounts are affected.

- The finance department then stamps the documents with a ‚Paid‘ designation to prevent duplicate payments before returning them to accounting for record-keeping.

- The general ledger is a central database that stores the complete record of your accounts and all transactions recorded in those accounts.

- You might find early on that your system needs to be tweaked to accommodate your accounting habits.

Modifications for accrual accounting versus cash accounting are often one major concern. The accounting cycle is a methodical set of rules that can help ensure the accuracy and conformity of financial statements. Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors. Ray prints out his trial balance and what is cloud bookkeeping quickly scans the ending balance for each account, looking for any irregularities or unexpected balances. For example, Ray notices a large ending balance in prepaid rent when he knows he hasn’t yet paid rent for the coming month. He investigates and realizes he forgot to make an adjusting journal entry to move last month’s rent from prepaid expenses to rent expense.

After journalizing, the accounting transactions are posted to their relevant ledger accounts. This step classifies and groups all entries relating to a particular account in one place. For example, all entries relating to sales are recorded in the sales account. Similarly, all transactions resulting in inflow and outflow of cash are entered in the cash account.

This process is repeated for all revenue and expense ledger accounts. Balance sheet accounts (such as bank accounts, credit cards, etc.) do not need closing entries as their balances carry over. The last step in the accounting cycle is preparing financial statements—they’ll tell you where your money is and how it got there. It’s probably the biggest reason we go through all the trouble of the first five accounting cycle steps. Through the accounting cycle (sometimes called the „bookkeeping cycle“ or “accounting process”).

Adjusting entries are made at the end of an accounting period to adjust those accounts that need to be updated or adjusted. Adjustments include the recording of depreciation expense, the gradual release of prepayments, and the recording of earned revenue from unearned revenues at the end. Understanding the accounting cycle is important for anyone in the world of business. Through accounting, financial responsibility can be taken by a company. It allows them to look at the bigger picture, and see how they’re doing business. Without accounting, the financial position of a business cannot be analyzed.