What is Product Cost & How to Calculate it? With Examples Glossary

Understanding product cost is essential for determining the profit margin of a product. The profit margin is the amount of money a company earns after it covers its costs. If the product cost is high, the profit margin will be low, and vice versa. By understanding their cost structure, businesses can better identify opportunities for improvement and make informed decisions about how to price products in the marketplace. With a solid financial plan in place, you can identify which components are driving up your product costs and adjust accordingly.

Accuracy of Expenses Incurred

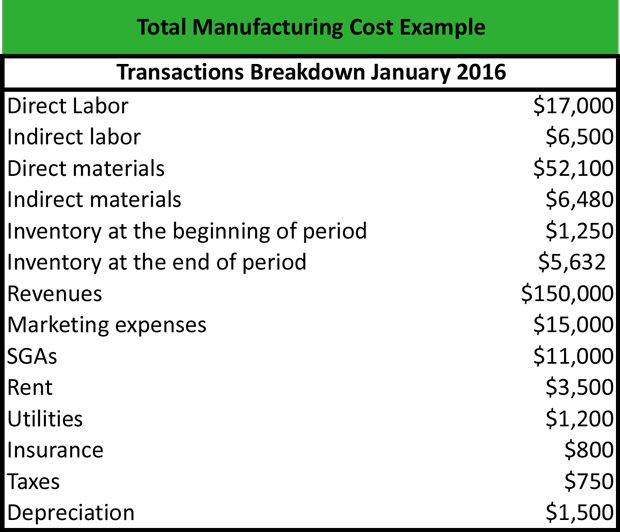

- Costs not included with factory overhead are selling costs and general administrative expenses.

- The remaining inventory of 200 units would not be transferred to cost of good sold in 2022 but would be listed as current asset in the company’s year-end balance sheet.

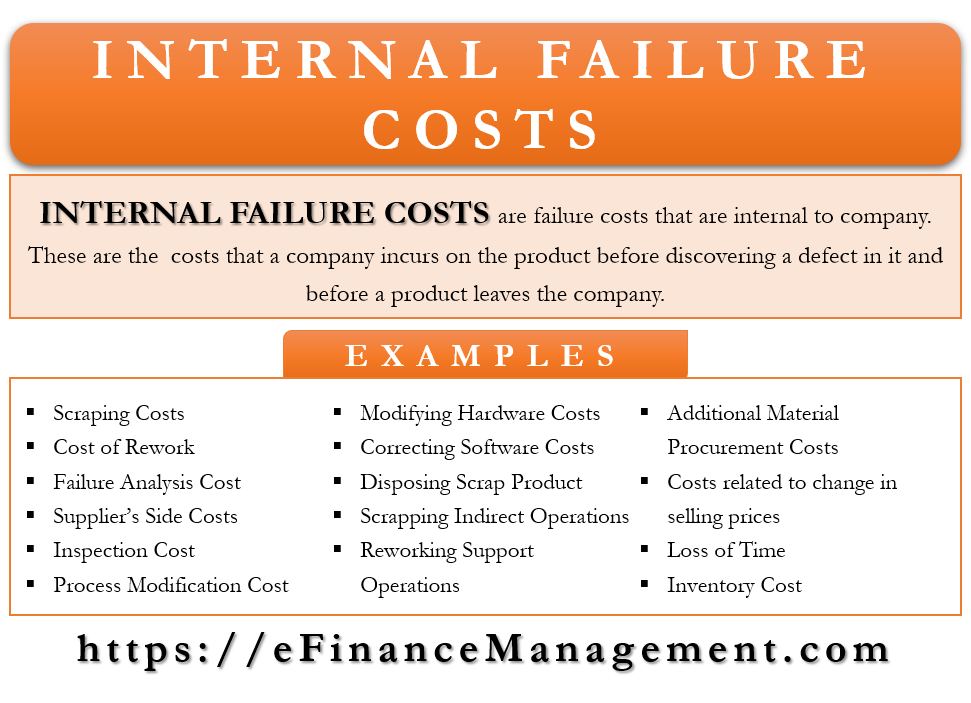

- Cost can increase when there is bad management or poor communication between departments in a company.

- You also need to invest in marketing, sales, customer support, legal, and more to ensure your product reaches the hands of the customers you want to serve.

- Once manufacturing is completed, all costs are automatically added together for a clear overview.

- Many businesses use a standard cost system to calculate their product costs accurately.

Managing product and production costs is essential for a successful business operation. It’s crucial to develop strategies to reduce production costs while controlling product operating profit vs net income costs so prices remain competitive. With careful planning and analysis, businesses can effectively manage product and production costs to maximize profitability.

Get manufacturing know-how delivered to your inbox!

Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. Marginal costs will help find the ideal and most optimum level of production for your product or service. Understanding average cost is an effective way to help determine the final selling price with details from the balance sheet.

Why You Can Trust Finance Strategists

Every business operation incurs both direct and indirect production costs. The product costs are sometime named as inventoriable costs because they are initially assigned to inventory and expensed only when the inventory is sold and revenue flows into the business. Production costs, which are also known as product costs, are incurred by a business when it manufactures a product or provides a service. For example, manufacturers have production costs related to the raw materials and labor needed to create the product. Service industries incur production costs related to the labor required to implement the service and any costs of materials involved in delivering the service.

The best solutions initially estimate and later, after production, accurately calculate the cost per unit based on some of those inputs. In addition to categorizing costs as manufacturing and nonmanufacturing, they can also be categorized as either product costs or period costs. This classification relates to the matching principle of financial accounting. Therefore, before talking about how a product cost differs from a period cost, we need to look at what the matching principle says about the recognition of costs.

Customer/Partner benefits

The manufacturing costs differ per factory due to the different business environments in different countries. This can result in a batch of drinks whose production cost is too high to realize a profit. Knowing how much it cost to produce your goods will enable you determine your profit margin. Whereas the security guard does not do any manufacturing, securing the area of production is part of the cost you should consider for your end products. When you know that you used a certain number of bottles, then the cost of one multiplied by the number of bottles gives you the total material costs for the bottles. Direct material costs are those you can trace directly into the finished goods.

To prevent losses, the sales cost must be equivalent to or greater than the product cost per unit. Product and period costs are two different types of costs that are incurred in producing and selling goods. On the other hand, depreciation is an indirect cost typically assigned to all products a company produces. Depreciation represents the gradual reduction in the value of a company’s fixed assets, such as buildings, equipment, and machinery, over time due to wear and tear.

The amount of these resources can be easily counted or kept as a record. However, manufacturing a car also requires lubricants like oils and grease. Still, it is very difficult or insignificant to trace the low value of grease used in a particular vehicle hence referred to as indirect costs.

The software provides an array of tools that simplify the cost-tracking process and allow you to focus on what really matters — your business. Calculating the cost of production is a critical aspect of cost accounting. Understanding these types of production costs is crucial for accurate cost accounting and effective management of production costs. Knowing the cost of a product is critical to the business since it must manage its costs to remain profitable. You may come upon a sales opportunity where the incremental income and expenses for that one transaction are all that matters. Managers may also want to concentrate on a product’s impact on a bottleneck activity.